Whether you're a new driver looking for your first policy or a seasoned motorist seeking better coverage, bonkers.ie is the smart way to get car insurance. And now you can choose insurance with leading provider AIG!

We’re all about saving people money here at bonkers.ie. And one area where Irish households absolutely LOVE to save is on their car insurance!

That’s why just over two years ago we launched our car insurance service and in that time we’ve helped thousands of drivers save money on their premiums.

And now we’re delighted to announce that leading global insurer AIG has joined our insurance service, offering more choice and the potential for bigger savings for our customers.

So whether you're a new driver looking for your first policy or a seasoned motorist seeking better cover, our user-friendly car insurance service can help you get on the road to cheaper car insurance in minutes!

Here’s everything you need to know about AIG and its car insurance offering on bonkers.ie.

Cover for all budgets

Whether you're looking for basic cover or comprehensive protection, AIG provides options that can be customised to fit your needs and budget.

You can choose from third-party fire and theft or fully comprehensive cover, both of which come with a range of additional benefits as standard such as windscreen protection, cover for fire brigade charges, and step-back no claims protection. Optional extras include full no-claims bonus protection and breakdown assistance.

Another great benefit is the option to get same day insurance.

However a key feature of all AIG car insurance policies on bonkers.ie is the use of telematics, which AIG calls BoxClever insurance…

AIG BoxClever insurance

The type of car insurance that AIG sells on bonkers.ie is a telematics product called BoxClever insurance.

What this means is that a telematics device or ‘black box’ will be installed in your vehicle shortly after your insurance policy comes into force. The small device will track various aspects of your driving and provide detailed analytics on your driving behaviour to both you and AIG.

This information can then be used by drivers to improve their driving, making the roads safer for everyone. And it also allows drivers, especially younger drivers, to avail of more affordable premiums.

You can learn more about the use of telematics in car insurance here.

How does the telematics device work?

The black box that’s installed will help you understand your driving and become a better driver by providing information about the following:

- Where you drive

- The time you drive at

- The length of your car journeys

- Your speed

- How smoothly you brake and accelerate

- How well you take corners

- The distance you drive, including your total mileage - when taking out a policy you can choose to buy up to 25,000km of driving. Your premium will be partly based on how much driving you do. If you go over your driving limit you can choose to buy extra kilometres and in some cases you can be awarded extra kilometres for free if you’ve demonstrated good driving behaviour

Who fits the BoxClever device in my car?

Once you've purchased your policy, AIG will contact you to arrange a visit from an installer who'll come fit the telematics device in your car for free. This will be within 14 days of your policy go live date. However you'll still be insured during this period.

The device will usually be installed under the bonnet of your car so no one will even see that it’s there. And don't worry, the telematics device won't have any effect on the performance of your car in any way.

How do I see the information that has been gathered?

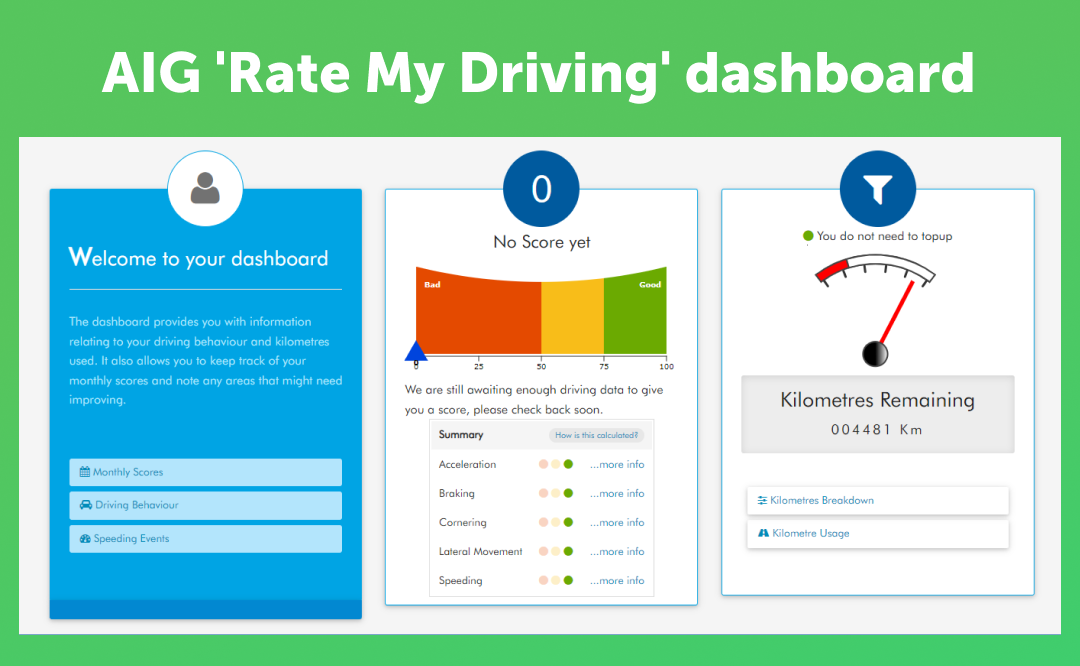

AIG has an online portal called MyAIG, which allows you to view your policy documents, make changes to your policy, update your personal details and more. Within the portal is a section called Rate My Drive, which will display all the information that has been gathered by the black box. This will be updated on around a 24-hour basis.

A rating will be given for each of the safe driving criteria that AIG monitors. You can then use this information to gain detailed insight into your driving and make improvements where necessary.

Insurance for everyone

Telematics car insurance or black box insurance is traditionally associated with younger drivers. And this cohort in particular can make big savings by choosing this type of policy. Indeed, for many young drivers, it’s the best way to get affordable car insurance.

However it’s open for purchase by anyone and has a range of benefits for drivers both young and old.

For example, at present anyone who has accumulated six or more penalty points can find it very difficult to get car insurance. But black box technology allows insurers to 'take a bet' on drivers with riskier past behaviour.

Similarly, if you're new to Ireland you won't have built up any no-claims bonus here. This can make getting insurance difficult. Not to mention expensive. So telematics solutions can make getting insurance for recent arrivals to Ireland easier and more affordable. And of course, once you've built up driving experience here you can always change to a non-telematics policy when it's more suitable to do so.

Another benefit is that the device works as a type of built-in theft tracking device. If you're unlucky enough to have your car stolen, the black box will enable you to find your vehicle quicker. And having a record of where and when your car was stolen will also make it easier to process an insurance claim.

BoxClever telematics insurance also works as an accident alert system. If the device senses a strong impact, AIG will try and check you’re OK, and if necessary will try to contact the emergency services.

But perhaps most importantly, telematics insurance has the potential to enhance road safety, which is more important than ever given the recent uptick in deaths on the roads in Ireland. By monitoring driving habits such as speed, braking and acceleration, and even the time you drive at, the device encourages motorists to adopt safer behaviours. The real-time feedback provided by the black box also serves as a valuable tool for self-improvement, helping drivers identify and rectify bad driving habits. Therefore, not only can telematics technology make car insurance more affordable for certain drivers, it can also lead to better drivers and safer roads for everyone. A real win-win.

bonkers.ie - the smart way to compare car insurance

Getting started is simple. Just head to our car insurance page, enter your registration number, answer some simple questions about yourself and your driving history, and begin comparing quotes.

And when you compare car insurance on bonkers.ie you’ll be quoted a direct price for your insurance. In other words, the price you see on bonkers.ie is the same price you’d pay as going direct to any of the insurers. There are no extra broker fees or charges added on by us. This, believe it or not, makes bonkers.ie the only true comparison service for car insurance in Ireland.

Reduce your other insurance costs

As well as helping you save on your car insurance bonkers.ie can also help you save on your other insurance costs. You can easily get quotes for home insurance, life insurance, serious illness cover and mortgage protection on bonkers.ie in minutes.

And we can help you switch and save on your energy and broadband too.

Take control of your bills today!