At bonkers.ie we’ve just launched our new car insurance service! You can now apply for cover online through bonkers.ie and start saving on your car insurance costs in minutes.

Over the last two years, bonkers.ie has branched into the insurance market. We first started offering life insurance, mortgage protection insurance, and then home insurance services.

Led by our team of in-house experts, our insurance services have grown from strength to strength, and have ensured Irish consumers get the best value for money.

With that in mind, we're delighted to announce that we've now added car insurance to our suite of insurance products that we can help you save money on.

Similar to our home insurance service, which we launched last October, you will now be able to apply online for cover on your car in a quick and easy fashion.

You already know us from helping you switch and save on your energy, broadband and other insurance products. Why not let us help you save on your car insurance costs too?

Save on car insurance the bonkers.ie way

Car insurance is a huge annual cost for most and is a legal requirement if you want to drive on Irish roads. Yet too many drivers stick with the same insurer, meaning they could be missing out on potential savings.

Our new car insurance service allows you to get a direct discounted quote from insurers, helping you reduce the price you pay for your annual premium.

It’s quick and easy and can be carried out online in just a few minutes. And best of all, it’s completely free!

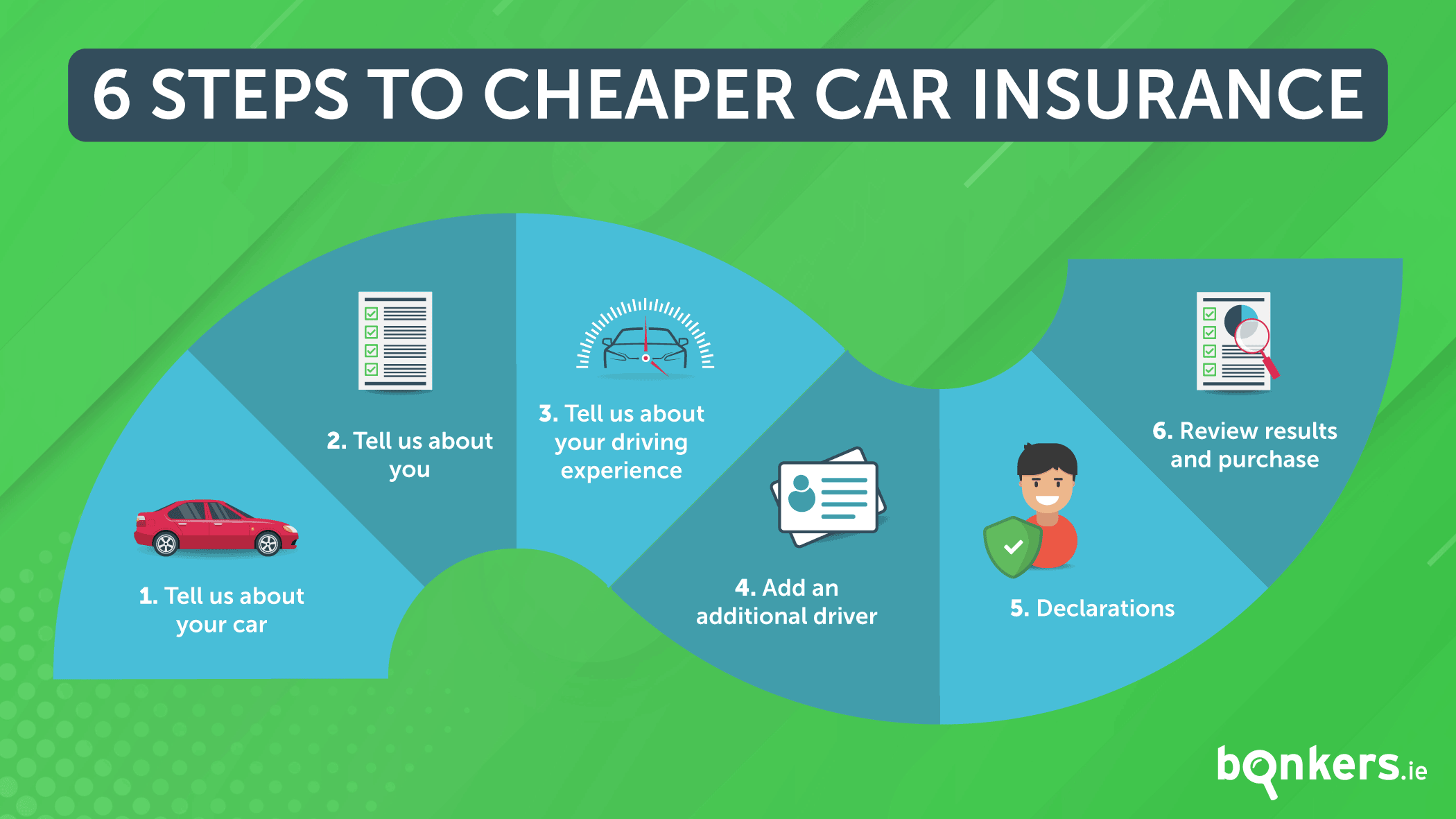

Six steps to cheaper car insurance

There are only a few simple steps involved in getting your car insurance quote:

- Your car: Head over to our car insurance service page and input your car registration number to get started. Provide us with some details about your car, such as its value and its built-in security features.

- About you: In addition, we’ll ask you to provide us with some personal information, such as your contact details.

- Driving experience: Then you will be required to outline your driving experience and no-claims history.

- Additional drivers: Want to add an extra driver to your policy? You’ll have the freedom and flexibility to add up to 3 extra drivers to your insurance cover at this stage.

- Declarations: Here you can choose the start date of your policy. Finally, you’ll be asked to review and agree to the required declarations.

- Your results: Once your details have been submitted, your cover will be displayed instantly and you can choose the option that best suits you.

To get started, head to our new car insurance page. And for more information on how to use our new service, take a look here at our step-by-step guide.

A policy tailored to you

You’ll also have the opportunity to filter your results, where you can fine-tune your search and modify your claim excess.

From third-party to fully comprehensive cover, you can choose which policy suits your needs and budget best.

As well as standard cover, you’ll have the opportunity to purchase optional add-ons, such as legal expense protection.

If you’re happy with your policy, you can proceed with your purchase and be covered in just a few minutes!

A fully digital experience

Our car insurance service is fully online and paper-free, so you can complete your application from a location that suits you and digitally sign any documentation required.

Despite our service being digital, our expert insurance advisors will be on hand to help should you require any assistance at any point in the application process.

Switch and save on bonkers.ie

Did you know that we also provide a range of other comparison tools that will help you save money? Take control of your household bills with bonkers.ie.

You can compare deals and prices for energy, broadband, and banking products, as well as other insurance products. See what other everyday bills you could save on today!

Helpful articles for motorists

Looking for more helpful car insurance-related information? Whether you’re an experienced driver or are a first-time driver, you may find the following articles beneficial:

- When taking out car insurance, motorists often overlook several important aspects that can lead to them overpaying or not receiving adequate cover. To avoid this, check out the 10 biggest mistakes made when buying car insurance.

- To help guide you on your car insurance journey, keep these 12 considerations in mind when taking out cover.

- New to driving? Take a look at our car insurance tips for first-time drivers.

- We separate fact from fiction in our article on 15 car insurance myths debunked, making it easier for you to navigate the car insurance world.

Keep an eye on our blogs and guides pages to stay up-to-date with the latest car insurance news and top tips.

Get in touch with us

Do you have any questions about our new car insurance service? If so, feel free to get in touch.

You can comment below or contact us on Facebook, Twitter and Instagram.