Specified illness cover is a type of life insurance that helps to provide extended financial security for both you and your loved ones should you develop a serious illness.

Many of our customers will know us from switching and saving on their energy bills, but it might come as a pleasant surprise to know that we also now compare insurance. From mortgage protection to life insurance, we've got you covered at bonkers.ie.

But one particular type of insurance has been on our minds of late and that's specified illness cover.

Specified illness protection can often be an inexpensive type of life insurance and can provide much needed financial security for those who choose to take out a policy.

But as with all forms of life insurance, as your age increases, so too does the cost, and specified illness cover is no different. The longer you leave it, the more it will cost you unfortunately.

So in this article we'll take a look at some of the most important aspects of specified illness cover and why you should consider taking out a policy sooner rather than later.

But first, a reminder!

What is specified illness cover?

Specified illness cover (SIC), also known as serious illness cover, is a type of life insurance policy that helps to protect you and your loved ones financially should you be diagnosed with a debilitating illness that’s covered on your policy.

A form of life insurance, serious illness cover pays out a tax-free lump sum upon diagnosis where the insured is unable to work due to illness, and is often used to pay household bills such as a mortgage. A serious illness policy can also be used to help pay any rehabilitation costs incurred as a result of sustaining a serious injury, which can include the cost of surgery as well as medical bills.

While SIC is often taken out as a standalone policy, it is most commonly included as an additional level of cover when purchasing a mortgage protection or life insurance policy.

Why you might need it

Increased cover

Depending on what type of insurance you already have in place, this may or may not include serious illness cover. If you're considering taking out a specified illness policy then the first steps should be reviewing your existing policies with a broker or financial advisor to make sure you know what exactly you're covered for, and perhaps more importantly, what you're not covered for.

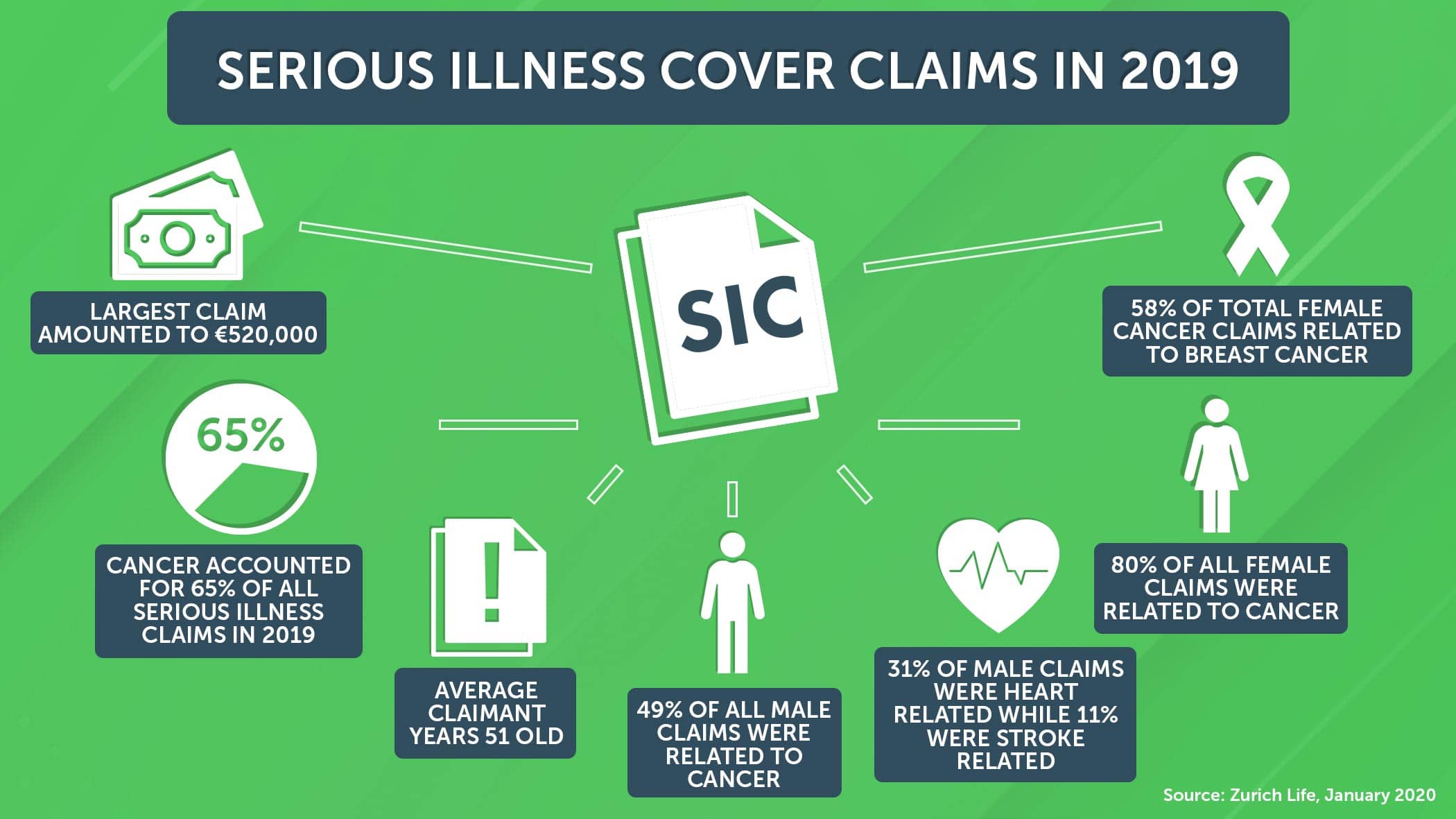

If you only have mortgage protection, for example, you should consider taking out a specified illness policy so that you're covered if you get struck with a serious illness, especially cancer. Research from Zurich Life Insurance shows that cancer accounted for 65% of all serious illness claims in 2019, while the average claimant was only 51 years old, so having cover in place for a common illness like this is crucial.

Financial security

When buying your first home chances are you had to take out mortgage protection insurance, but when doing so you probably didn't really consider taking out serious illness cover.

Unlike life insurance and mortgage protection policies which only pay out after you die, specified illness cover pays out a tax-free lump sum if you're struck down with an illness and are unable to work for a period of time.

Most people don't worry about what might happen if they couldn't work for six months, and thankfully don't have to, but there are so many benefits to having a serious illness policy in place and one of them is the increased financial security.

A one-off lump sum payment helps to allay the financial and emotional pressure that goes with being diagnosed with a serious illness. Having cover in place allows you to not have to worry about taking time off work, meeting monthly bills such as mortgage repayments, or even weekly outgoings such as the costs of childcare and food.

If you think your finances could be put at risk upon being diagnosed with a serious illness we would advise looking into taking out extended serious illness cover on an existing policy, or even standalone cover today.

Not enough savings

While 2020 saw an increase in bank deposits and more Irish households saving more money due to being in lockdown, the reality for many Irish people is that they may not have ample savings to see them through an unforeseen serious illness.

An important step before taking out cover is looking at the savings you have, assessing how much your outgoings are each month, and then working out how long your savings would realistically last.

If for example your monthly household expenses are €2,500, that means you'd need cover of €30,000 if you were out of work for a year. If your savings wouldn't go that far, and for most people they wouldn't, you should definitely consider looking at specified illness protection.

If using your savings is something you’d consider doing, you can use our savings account comparison tool to compare interest rates and account features. You can also take a look at alternative, less traditional methods of saving here.

Poor sick pay

Another important step before taking out specified illness cover is taking a look at what sick-pay arrangements your employer offers.

Some people may be lucky enough to have enough cover in place from their employer, taking into account possible savings too. However, this might not be the case for many employees.

If the sick-pay arrangement with your employer is unsatisfactory and doesn't meet your financial requirements should you fall ill, you should consider getting in contact with a financial advisor about getting extended cover in place.

See what you could expect to pay per month for cover using our specified illness comparison tool today.

The sooner the better

As we mentioned above, the longer you leave before taking out specified illness cover, the more expensive it will be. Conversely, if you take out a policy when you're younger it's going to cost you far less per month.

Take for example if a 30 year old non-smoker was looking to take out €30,000 worth of cover over 10 years and applied today. That same person would be paying a little over €10 per month.

All the while an individual in similar financial circumstances but who is 50 years old could expect to pay approximately €20 more per month.

Apply today on bonkers.ie

Applying for specified illness cover has never been easier when you use our serious illness comparison service on bonkers.ie.

Easily compare cover across all of Ireland’s main insurance providers in just seconds with our impartial and 100% free comparison service.

To get a full comparison all you have to do is complete a short form telling us how much cover you require and whether you'd like a single policy, a joint policy, or additional benefits such as indexation.

Meanwhile, if you're looking to do some more research why not read this piece we wrote which takes a look at 7 things to know before taking out a serious illness policy.

Don’t forget that as well as serious illness cover, you can compare a range of other insurance policies on our website, such as mortgage protection insurance and life insurance.

At bonkers.ie, we’ve got you covered.

Got any questions?

Wrapping your head around any type of insurance policy can be quite confusing but don’t worry, we’re here to help.

At bonkers.ie we have our own in-house insurance broker team made up of qualified advisors. So if you have any questions, we’d be happy to help answer them!

Comment below or get in touch with us on Facebook, Twitter or Instagram.