At bonkers.ie we're always looking out for ways that our customers can save. And what better way to save some serious money than on your mortgage!

We’re obviously a big fan of switching here at bonkers.ie but particularly when it comes to mortgages as the savings over the lifetime of the loan can be huge!

We’ve taken a look at all the mortgage lenders in Ireland to find out who's offering the best rates and what you could save by switching.

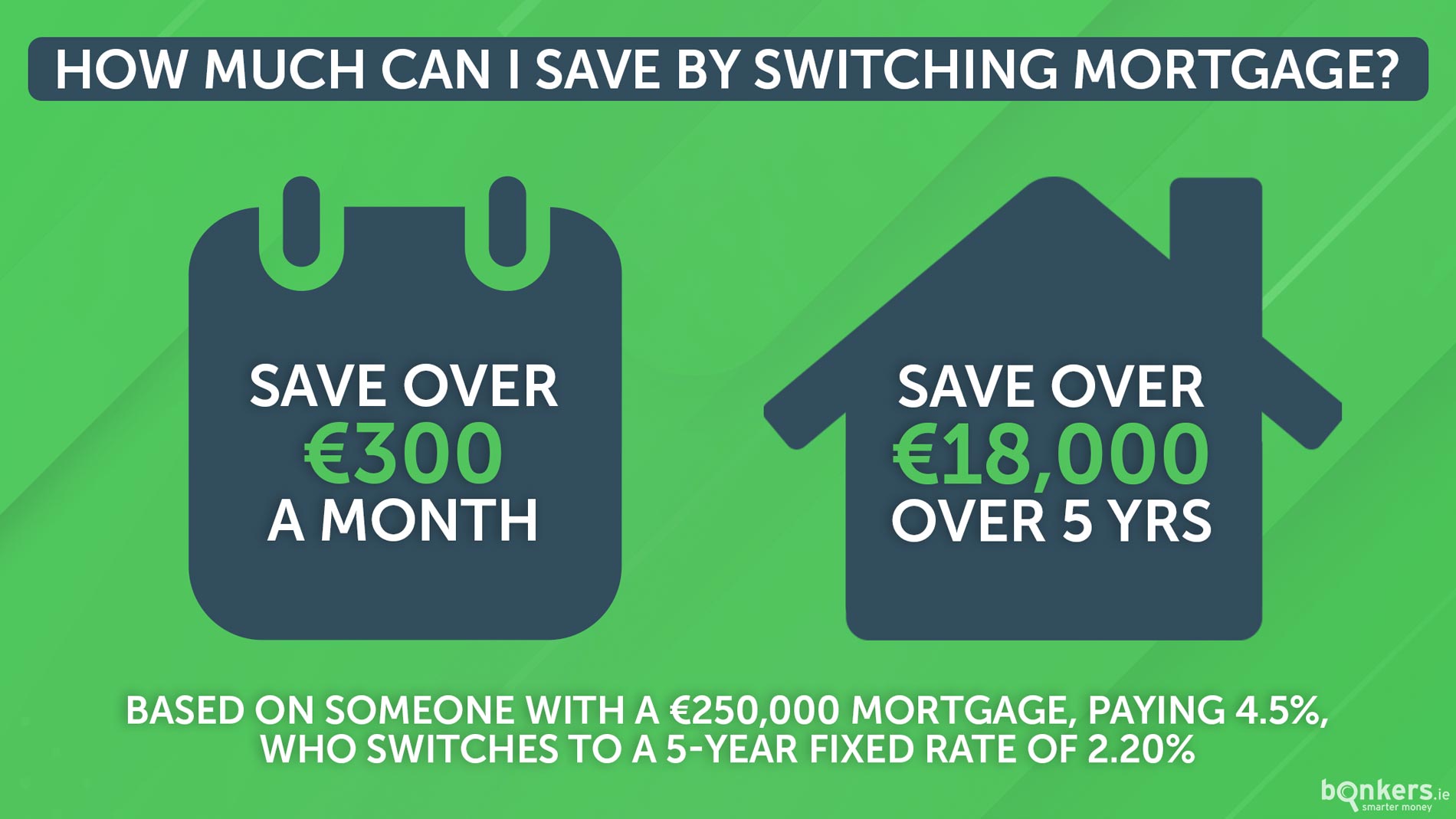

All our comparisons are based on someone who’s looking to switch a mortgage of €250,000, with 25 years remaining, who’s currently on a variable rate of 4.5%, and has between 20% and 40% equity in their home. Your potential savings could be more, or less, depending on the rate you’re actually paying and how much you're looking to switch, but it’ll give you a good idea of what you could save.

If you have more than 40% equity in your home i.e. a loan-to-value ratio of 60% or better, you may be able to avail of even lower rates than the ones outlined below.

Which banks offer the best mortgage rates?

Let’s first look at fixed rates, which currently offer the best value for mortgage customers.

The cheapest deal on the market right now is the 1.90% four-year 'green' fixed rate from Bank of Ireland, which works out at a repayment of €1,047.51 a month or a saving of €342 a month. However your home has to have a Building Energy Rating (BER) of at least B3 or better to get this rate and you must be switching at least €250,000.

Another option is the 2.15% five-year 'green' fixed rate from AIB, which works out at a repayment of €1,077.99 a month or a saving of €312 a month. What's more AIB is offering €2,000 cashback to switchers right now. And if you pay your mortgage back from an AIB current account you'll get free everyday banking. However once again your home has to have a BER of at least B3 or better to get this rate.

If you can't qualify for a green mortgage rate, then check out the 2.15% fixed rate over three or five years from Avant Money where there is no BER requirement.

Another good option is Permanent TSB which is offering a 2.25% fixed rate over four years. This works out at a monthly repayment of €1,090.33 or a saving of just under €300 a month. However PTSB's usual 2% cashback deal doesn't apply to this rate.

If you’d prefer the flexibility of a variable rate, the best rate on offer is 2.70% from ICS Mortgages. This equates to a monthly repayment of €1,146.89 or a saving of around €243 each month.

| Bank | Rate | Monthly repayment on a €250,000 mortgage | Potential monthly saving* |

| BOI** | 1.90% fixed over 4 years | €1,047.51 | €342 |

| Avant Money | 2.15% fixed over 3 or 5 years | €1,077.99 | €312 |

| PTSB | 2.25% fixed over 4 years | €1,090.33 | €299 |

| Finance Ireland | 2.40% fixed over 3 years | €1,108.99 | €280 |

| ICS Mortgages | 2.45% fixed over 5 years | €1,115.26 | €274 |

| ICS Mortgages | 2.70 variable | €1,146.89 | €243 |

| EBS*** | 2.75% fixed over 5 years | €1,153.28 | €236 |

| AIB, Haven | 2.95% variable | €1,179.04 | €211 |

*Based on someone who’s currently on a 4.5% variable rate, with €250,000 and 25 years remaining, and an LTV of at least 80%.

**Must be borrowing at least €250,000 to avail of this rate. No cashback available with this rate.

***Up to 3% cashback available.

Switching costs

There will be costs associated with switching your lender. This will mainly be in the form of a solicitor's fee as well as a property valuation fee.

The good news is that many lenders are offering cashback of up to 3% of your mortgage to help towards (or in some cases more than offset) these costs. See here for who's offering what to switchers.

As a general rule though, regardless of whether your new lender is offering you cashback, if you're paying a rate of 3.5% or more on your mortgage, you'd be crazy not to switch.

Should I switch mortgage provider?

In recent times Irish mortgage holders have been reluctant to switch mortgage provider but as you can see the potential savings for those who do switch can be huge.

Many lenders also have dedicated switch teams in place to make the process as easy as possible so it often won’t be as much hassle as you think. And while there are costs associated with switching mortgage provider, in some cases banks will provide cashback to those who switch or a contribution towards the legal fees.

However, a word of caution. If you’re currently on a fixed rate you’ll need to wait until the end of the fixed rate period before you can switch mortgage provider, otherwise you could be charged a breakage fee. And if you’re lucky enough to be on a tracker mortgage, the chances are you’re already on the lowest rate available so there would be no point in switching.

Compare mortgage rates

To see exactly how much you could save by switching, check out our handy mortgage calculator.

When it’s time to apply to switch your mortgage, you can submit an online enquiry through our new mortgage broker service and one of our experienced financial advisors will call you back to get your application started.

Our mortgage service is entirely free and is fully digital from start to finish, meaning everything can be carried out online from the comfort of your home. And it's completely paper-free too!

To find out more about our mortgage broker service, see here.

And if you want some info on the steps involved in switching your mortgage, check out our handy guide on how to switch your mortgage.

Did you know that if you already have mortgage protection insurance you can also switch that? Mortgage protection premiums have gone down considerably over the last number of years, so you could be overpaying on your existing policy.

You can use our quick and easy comparison tool to discover what you could save on your mortgage protection premium by switching!

Get in touch with us

Would you consider switching your mortgage to save money?

If you have any questions about switching, let us know in the comments below. Alternatively, you can reach us on our social media pages. We’re on Facebook, Instagram, and Twitter.