Although there are costs with switching your mortgage, there are also big savings to be made. And many lenders will provide cashback to help with the legal fees.

Switching bills can sometimes feel a bit daunting, particularly when it comes to something as important as your mortgage. Then there’s the paperwork that's involved. And significantly, there’s also the cost.

However many lenders now offers sizeable cashback incentives to encourage people to switch, which in many cases will more than offset the legal fees.

So, let’s take a closer look at those fees, see what they’re for and find out how much they’ll cost you.

Why do I need to pay legal fees to switch mortgage providers?

If you decide to switch mortgage providers, you must employ a solicitor to take care of the processing, paperwork and liaising. Thankfully, when it comes to switching, the cost and workload for the solicitor is about half of what it is when buying a new property.

Most of your legal costs will go on your solicitor’s professional fee, with some extra euro going towards his/her outlays, associated costs and, of course, VAT. Here’s a summary of what they’ll do for their fee:

1. First, your solicitor will request the deeds to your home from your old bank and act as the point of contact with your new bank for the switching process.

2. Your solicitor will then invite you in for a consultation to go through the loan offer from your new bank and to advise on any questions or concerns you might have.

3. If you’re happy to proceed with the switch, you’ll sign a new loan agreement, which your solicitor will send to your new bank. If you wish to add a new name to the title deeds of your home, your solicitor can help with that too.

4. Once there’s a legally-binding contract in place, your solicitor will continue to deal with your new bank (and a broker, if there’s one involved) until your loan cheque is issued.

How much can I expect my legal fees to be?

All in all, legal fees for switching mortgage provider should amount to somewhere between €1,200 and €1,500 plus VAT at 23%.

As a first-time buyer, you would have paid a land registry fee to have your property registered in your own name. This is up to €800 but won't be incurred again. The only land registry fee you’ll incur will relate to the registration of your mortgage with the lender you're switching to.

Although not strictly a legal fee, there is always a valuation fee associated with switching mortgage too, which will cost you around €150 plus VAT.

Which banks will cover my legal fees when I switch?

Many lenders are actively targeting switchers and most now offer to cover some or all of the legal fees to encourage borrowers to move to them.

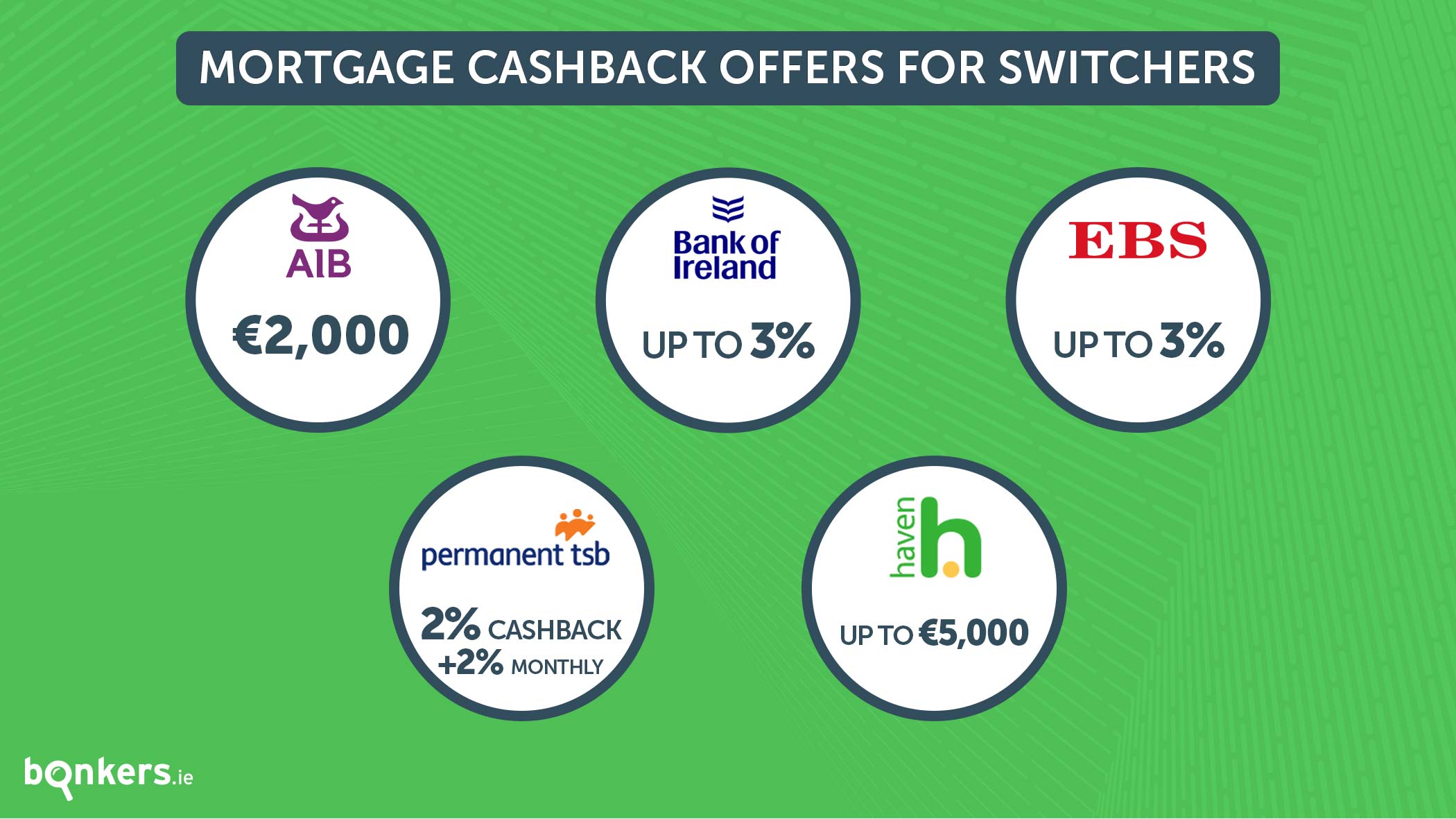

So here’s what’s on offer:

Avant Money - 1% cashback

If you switch to Avant Money and draw down your new mortgage between 3rd May and 29th November 2024 you’ll get 1% of your mortgage back in cash. So €2,000 in cash on a mortgage switch of €200,000 for example.

To avail of the switching offer you must have a minimum of €100,000 remaining on your mortgage.

Bank of Ireland – up to 3% cashback

Bank of Ireland has a 3% cashback offer which is available to all first-time buyers, movers and switchers who have a current account with the bank. You’ll receive 2% cashback after drawing down your mortgage from the bank and a further 1% in five years' time.

The 2% deal is still available to those who don’t have a current account with the bank.

Let's take a home worth €300,00. First-time buyers are permitted to borrow up to 90% of a property’s value, so in this instance they could get a mortgage worth €270,000.

With BOI’s 3% cashback offer, a first-time buyer drawing down a loan of this size could get €8,100 back in cash.

Figures like this can look extremely appealing, but it’s essential to consider the lifetime cost of the loan before making a decision. More on that later.

Some of BOI's lowest fixed rates don't come with any cashback and it no longer offers cashback on its variable rates. Our handy mortgage calculator will tell you which of BOI's deals come with cashback and which don't.

EBS - 3% cashback

Like BOI, you’ll receive 2% cashback upfront and a further 1% in five years' time.

It's not available if you choose a variable rate or a one-year fixed rate with EBS.

Staying with our example above, a first-time buyer could get €5,400 cashback upfront on a €270,000 mortgage and a further €2,700 in five years' time.

Unlike BOI's offer, there's no requirement to have a current account with EBS to avail of the deal.

EBS also has a separate €3,000 cashback deal to switchers who choose its green four-year fixed rate.

Haven - up to €5,000 cashback

Haven offers first-time buyers, movers and switchers €5,000 cashback on select fixed rates if they take out a mortgage of €250,000 or more. Haven's green four-year fixed rate, one of the lowest rates on the market, is excluded from this offer.

Switchers borrowing less than €250,000 are eligible for €3,000 cashback.

PTSB - 2% cashback

PTBS is offering 2% cashback.

Customers who make their mortgage repayments from the bank's Explore current account will also receive 2% cashback on their monthly mortgage repayments every month until 2030.

So a €270,000 mortgage would get you €5,400 cashback upfront and then a further €26.56 per month (€319 per year) until 2030 (monthly cashback based on a four-year fixed rate of 4.25% over a 30-year term).

Like BOI, some of PTSB's lowest fixed rates don't come with any cashback. Our handy mortgage calculator will tell you which of PTSB's deals come with cashback and which don't.

Who can switch mortgage?

Each bank has its own set of criteria for mortgage switchers and if your financial circumstances have changed for the worse since you qualified for your initial mortgage, you may have problems switching.

In general you also need to have around at least €50,000 remaining on your mortgage before a lender will consider your application. You also can’t switch if you're in negative equity. And ideally you should have at least 20%.

See our guide on how to switch your mortgage for more info on the process.

Can I switch mortgage provider if I took a cashback offer?

Although the banks won't be willing to admit it upfront, you can switch mortgage provider at any stage even if you've received cashback from your bank.

This is because under the EU's Mortgage Credit Directive from 2014, a bank can't seek to claw back any cash that it's paid out as part of your mortgage.

So theoretically, if you take out a mortgage with any of the above lenders, there's nothing to stop you switching to another lender in a few years' times without being penalised. However, if you take out a fixed-rate mortgage, you may need to wait until the end of the fixed-rate period, otherwise you could be charged a breakage fee.

Mortgage interest rates are where the real savings lie

While the prospect of having all switching legal fees covered is enticing, in most cases it is the interest rate on offer that will determine whether or not switching mortgage will save you money over the remainder of your loan.

Quite often, the lenders which offer some of the lowest rates and therefore the best longer-term value, offer no cashback at all.

If you're thinking of switching, our mortgage calculator will help you determine where your best long-term options lie.

Then if you decide to make the switch, you can submit an online enquiry through our mortgage broker service and one of our experienced financial advisors will call you back to get your application started.

Our mortgage service is entirely free and is fully digital from start to finish, meaning everything can be carried out online from the comfort of your home. And it's completely paper-free too!

To find out more about our mortgage broker service, see here.