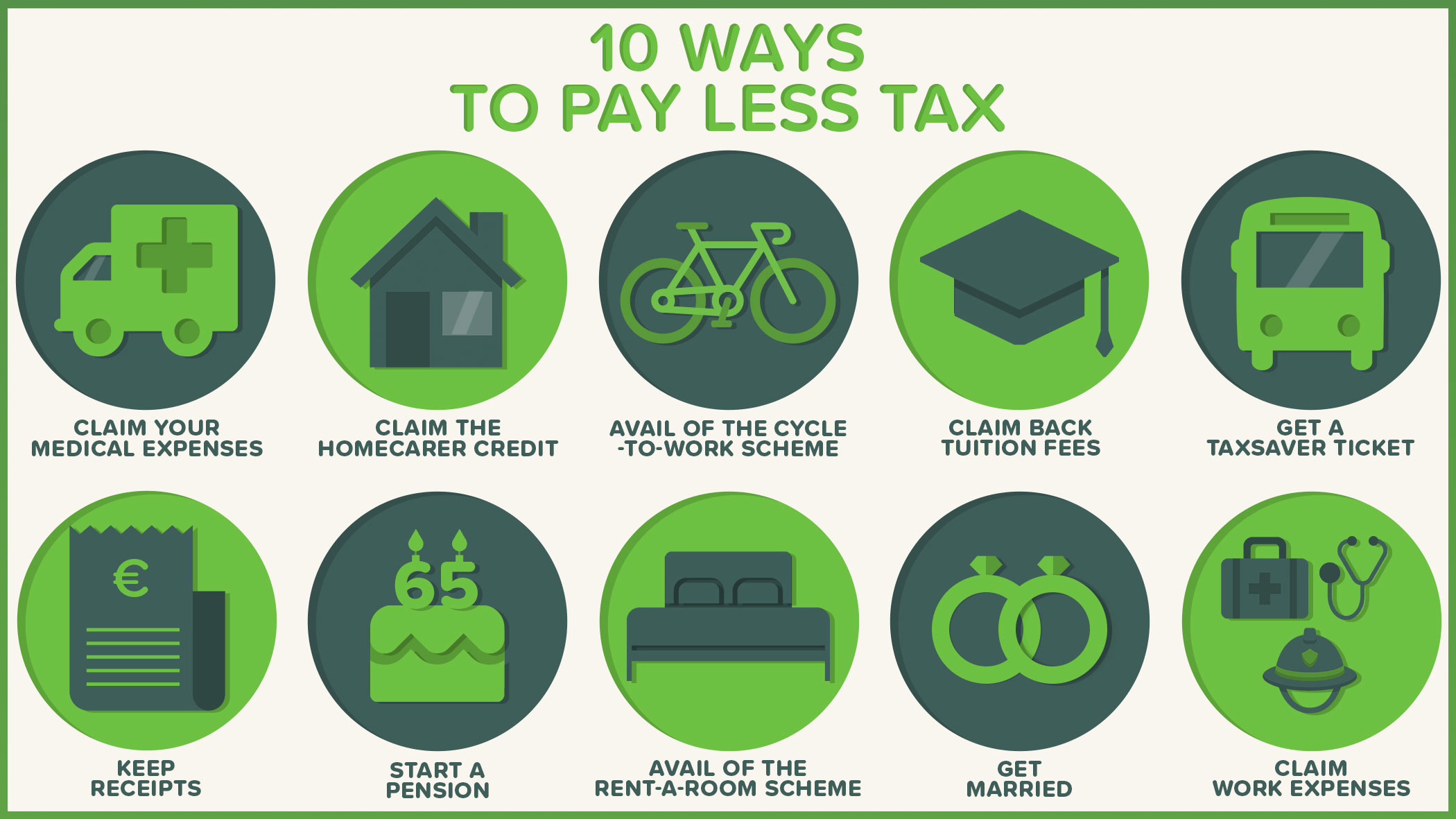

Death and taxes is a well-worn phrase at this stage so here's a list of 10 ways to pay as little of it as legally possible.

We all despair a little when we receive our payslips and see how much money we've handed over to the Government.

So we're here to salve that discomfort by giving you some advice on how to pay as little tax as you need to.

From keeping good records and claiming for medical expenses, to keeping abreast of all the tax credits you're entitled to, there’s a lot to unpack, so let's dig in...

1. Keep your receipts

The first part of not paying more tax than you have to is keeping your paperwork in order. This means keeping receipts of all your medical expenses, doctor's visits, and work-related expenses if you're self-employed.

While you're not obliged to submit your receipts when you initially claim a tax refund, Revenue carries out spot checks every year so they may come looking for proof of your expenses at some stage down the line. Revenue carries out spot checks for up to six years, so you'll need to keep your receipts for at least this amount of time.

2. Avail of all the tax credits available to you

Tax credits might sound complicated but in reality they're not. A tax credit works by reducing the amount of tax that you pay by the size of the tax credit. So a €500 tax credit would reduce your yearly tax liability by €500. A €1,000 tax credit means you pay €1,000 less in tax and so on.

There are lots of tax credits available yet it would amaze you how many go unclaimed every year.

For instance, most people are unaware of the home carer tax credit. This tax credit currently stands at €1,700 per year, having been increased by several hundred euro over the past few years, and can be claimed by any married couple or civil partnership where at least one of the spouses is a stay-at-home carer for either a dependant or their own children.

There is also the age tax credit. This is in addition to the personal tax credit that all workers are entitled to and may be claimed once you or your spouse or civil partner reaches the age of 65. If you're single or widowed it's €245 and if you're married it's €490.

And if you are recently widowed and have kids, you can claim a credit of €3,600 in the first year, tapering to €1,800 in year five.

And if you're a renter you can get a tax credit of up to €500.

So when it comes to the end of the year, or whenever it is that you do your admin duties at home, you should research all of the available tax credits available to the public and figure out which, if any, you qualify for.

3. Claim for work expenses

Certain professions can also claim for expenses (namely tools, uniforms and stationery) that are incurred as part of carrying out their day-to-day work. These are called flat-rate expense allowances.

For example a nurse who supplies and launders their own uniform can claim a tax allowance of €733. And a skilled worker in the engineering or electrical industry who bears the full cost of their own tools and overalls can claim an allowance of €331.

Tax allowances (also referred to as tax reliefs) work a little differently to tax credits. A tax allowance works by reducing the amount of income on which you pay tax. The value of a tax allowance will depend on whether it's allowed at the higher rate of income tax that you pay or is restricted to the standard 20% rate. Flat-rate expense allowances are allowed at the marginal rate of tax that you pay.

So take the example of the nurse who's claiming the allowance of €733. If he or she pays tax at 40% then it'll reduce their tax bill by €293.20 a year (€733 x 40%). If they only pay tax at 20%, then the claim of €733 will reduce their tax by €146.60 (€733 x 20%).

Other expenses can be claimed simply by being in a certain profession with no discernible expenses needing to be incurred in order to claim. For example journalists can claim a €381 allowance, firefighters a €272 allowance, dentists €376, and waiters and waitresses €80. Airline cabin crew, hospital staff, bar staff, and brick layers can all claim tax allowances too. The full list can be found here.

Flat rate expenses can be claimed in minutes online by completing a Form 12 in Revenue's myAccount service.

Many people are still working from home due to the global pandemic. However, 63% of those working from home last year were unaware of the tax relief available, which can help to cut down on the increasing costs associated with working from home. For more information, have a look at our guide on e-worker tax relief.

4. Claim for your medical expenses

One of the most commonly unclaimed tax reliefs is for medical expenses, where 20% can be claimed back - providing the money hasn't already been reimbursed through another source such as your health insurance for example.

Non-routine dental expenses like braces are also covered although things like fillings, scaling/cleaning and tooth extraction are all considered to be routine dental treatments, so won't be reimbursed unfortunately. However lots of other day-to-day medical expenses such as GP visits, consultant fees, prescribed physiotherapy and counselling sessions, acupuncture, routine maternity care, hearing aids, and IVF are all covered.

Again, expenses can be claimed back in minutes online through Revenue's myAccount service. As per our first point, remember to keep your receipts as you may be required to show them as proof at a later stage if Revenue decides to check your claim.

5. Get a refund on tuition fees

Tax relief at 20% is also available on eligible third-level tuition fees. Here the relief is available to the person who has paid the fees, not the person who's studying. So this means you could claim tax back on your children's tuition fees as well as your own if you go back to college.

The relief is available on both part-time and full-time courses.

However the relief only applies to amounts up to €7,000 per third-level course per year. Also, no relief is available for examination, registration, or administration fees or for things like student levies or sports centre charges.

The €7,000 limit is per course, per person, per academic year. So if you have paid fees for yourself and one of your children, are studying more than one course, or have two children in third level at the same time, you can claim up to €7,000 for each course.

Unfortunately the first €3,000 of fees for a full-time course and €1,500 for a part-time course do not qualify for relief each tax year. However this only applies to the FIRST claim you make; if you make a second claim in the same year then you can claim on the full qualifying amount up to €7,000.

6. Get married

Getting married is romantic and all, but most of the time it makes great financial sense, particularly if one spouse earns far more than the other. This is because you can split your tax credits between you.

Most PAYE workers are entitled to a €1,775 personal tax credit as well as a €1,755 PAYE/employee tax credit. Remember a tax credit simply reduces the amount of tax that you pay by that amount. So this means a PAYE worker can earn €17,750 a year before they start paying 20% income tax (as up until this point the €3,550 combined tax credit would more than offset the tax due).

However if you're earning a lot more than your spouse and/or your spouse isn't using up all of their tax credits, you can transfer some of your spouse's credits over to you to reduce your overall tax liability as a couple.

This might sound a bit complicated but the simple point to remember here is that the Irish tax system greatly favours married couples over single people so if you're recently married make sure you're taking full advantage.

7. Start a pension

Pensions are a fantastic idea that you can't take seriously early enough. They are a great way of gaining financial security and protecting your future. But they don't just make sense for that reason alone; pensions are extremely tax-efficient as any money that you save into a pension is exempt from income tax up to a certain limit.

What this means is that if you were to save €100 a month into a pension, you won't pay any income tax on that €100. So if you're a higher-rate taxpayer a €100 monthly contribution will cost you just €60 in net terms (the other €40 which you’re putting into your pension would otherwise have been taken from your payslip in income tax).

So as well as providing for your future, pensions allow you to give away less of your hard-earned money to the tax man. A real win-win.

Take a look at our beginners’ guide to pensions for more information on starting a pension.

8. Avail of the rent-a-room scheme

If you're lucky enough to own your own home and luckier still to have a little bit more space than you need, then you can get some much-needed help in the tax department.

Under the rent-a-room scheme you're allowed earn up to €14,000 a year entirely tax free by renting out a spare room in your home. This differs hugely from Airbnb where all the money you receive will be subject to income tax at your marginal rate (so 40% if you earn over €40,000 a year) with the online platform now sharing booking details with Revenue to ensure the appropriate tax is paid!

9. Get a bike

The Cycle-to-Work Scheme was launched in 2014 and aims to encourage employees to cycle to and from work.

Under the scheme your employer can pay for a bike or bike equipment for you, which you then pay back through your salary over a period of up to 12 months. However you won't have to pay any income tax, PRSI or Universal Social Charge on your repayments.

There is a limit of €1,250 per bicycle purchased (increased from €1,000 in August 2020), €1,500 for electric bikes and €3,000 for ecargo bikes and the purchase can be made in any cycle shop.

So if you're a higher-rate taxpayer and you purchase a new bike for €1,000, it'll only cost you just over €500, spread out over 12 monthly payments.

10. Get onboard with a Taxsaver ticket

Similar to the Cycle-to-Work Scheme, the Taxsaver scheme incentivises people to use public transport to and from work. Again, under the scheme your employer pays for your public transport ticket which you pay back through your salary each month. You then don't have to pay any income tax, PRSI or the Universal Social Charge on your repayments meaning you can make big savings and pay less tax!

Claiming your tax refund

The best time to claim a tax refund is usually in January or February, after the end of the previous tax year. This can easily be done online through Revenue’s website.

Your claim will take around a week or two to process and if it's successful your refund will be credited directly into your bank account within around three working days.

For more information on claiming your tax refund, take a look at our guide on the topic.

Looking to save more?

With inflation on the rise due to the reopening of global economies, many consumers are looking to save more money.

You can easily cut back on your monthly expenses and we’ve compiled a list of blogs and articles to help you.

- If you’re still working from home, you may have noticed that household bills are increasing because of it. As well as claiming e-worker tax relief, there are many other ways to save money while working from home.

- Our everyday habits can have a significant impact on the planet and our pockets. Here’s a list of 16 ways you can use less electricity and save yourself money.

- Home insurance and contents insurance is essential to protect our valuables, but you shouldn’t have to overpay unnecessarily. Read more about how you can reduce your home insurance costs here.

- Switching mortgages may seem like a drastic step, but it can actually save you an abundance of money in the long run! For more information take a look at our recent blog on the topic.

If you have any questions about tax, we’d love to help. Feel free to comment below or reach out to us on social media.