Welcome to our second guide in our eight-part series on how to get the best value car insurance with bonkers.ie. In this guide, we will walk you through each stage you will encounter when searching for your new policy using our car insurance service.

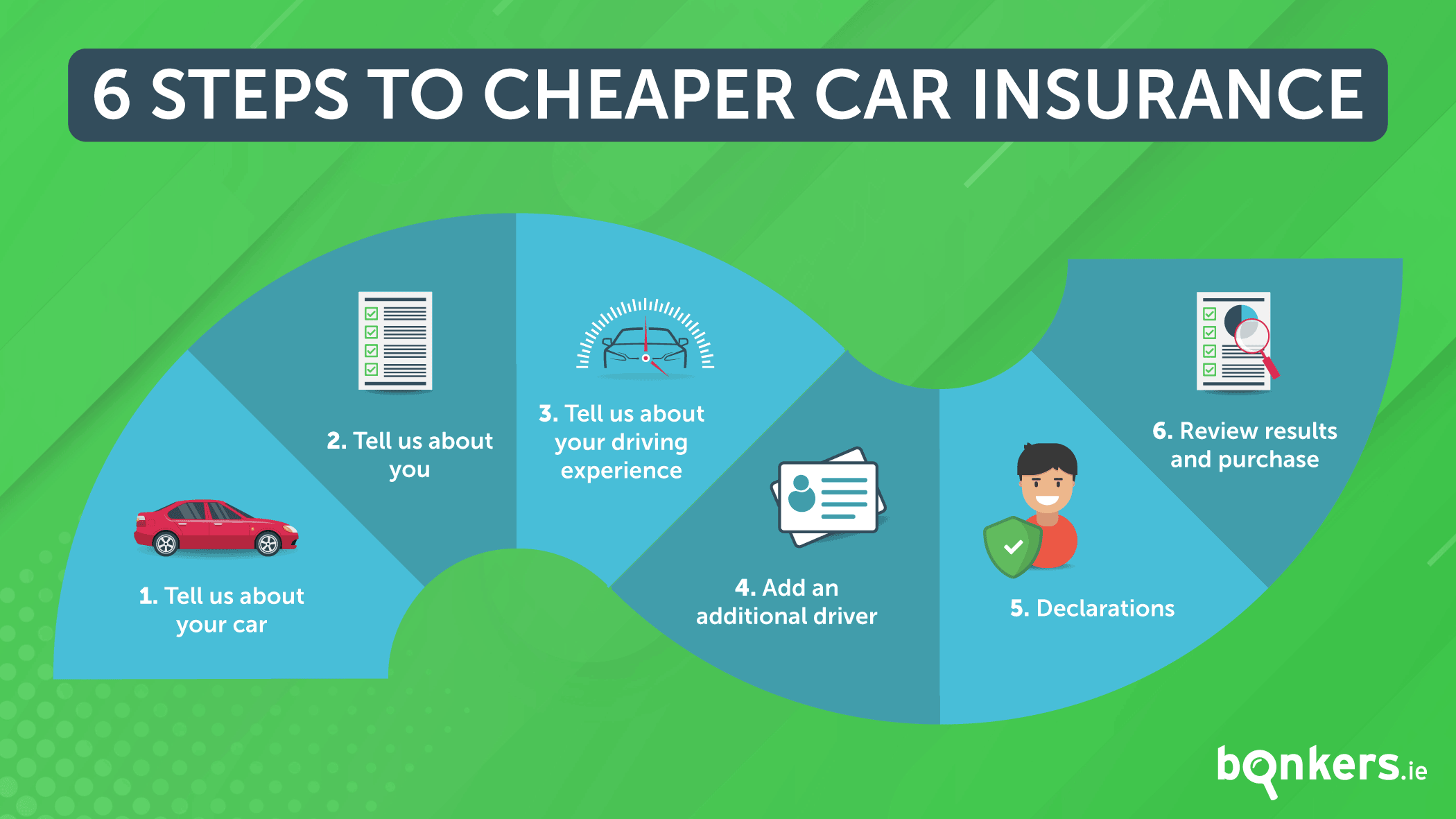

This 6 step process is outlined below and will help you easily navigate your way to getting a discounted car insurance quote on our site.

What you need to have

Before you begin this process you must have certain items or information on hand such as:

- Your driving licence

- Your claims history (if applicable)

- The number of penalty points you have (if applicable)

If you are adding an additional driver to your policy you will need to provide this information for them also, so make sure you have acquired their driving licence number in advance.

6 steps to cheaper car insurance

Step 1 - Tell us about your car

Head over to our car insurance page where you’ll be asked to input your car registration number. Don’t worry if you don’t know this - you can also search by make and model. However, should you wish to purchase the policy, the correct registration will be needed.

Car value: You’ll be asked to state the value of your vehicle. This is based on the market value of the vehicle and what you could reasonably expect to pay for the car today.

Should your car be damaged beyond economic repair, the amount compensated (indemnity) is calculated based on the lower of either:

- The value of the vehicle at the time of the loss based on the current market value.

- The value of the car as disclosed by you when arranging your cover.

Unsure how much your car is worth? Have a look online and see how much your car is selling for. When searching, you should consider your car’s age, mileage and condition.

Your address: We’ll need to know your address or Eircode, and where your car is parked overnight. Some areas will have higher claim rates which may result in higher premiums.

Security measures: If your car is valued above €40,000, you’ll be asked what built-in security features it has. This includes alarms, immobilisers, and tracking systems.

What the car is used for: To help determine the right policy for you, we need to know what you use your car for.

- Domestic: You only use your vehicle for social, domestic and pleasure purposes. This excludes use associated with your business or travelling to work.

- Commuting: You use your vehicle for social, domestic and pleasure purposes, but also use it to travel to and from work.

- Class 1 Business: You use your vehicle for social, domestic and pleasure purposes, but also use it for business purposes. This excludes commercial travelling and the carriage of goods, samples and passengers in connection with any trade or business.

Step 2 - Tell us about you

Once you have completed the first step, it is time to tell us about yourself so that we can determine the right cover for you.

What do we need to know about you?

Your full name: This is the name your insurance policy will be registered under and should match the name on your driving licence.

Your email address and contact number: This contact information is needed so you can be sent your insurance policy documentation and confirmation of payment etc.

Your age: Your age will influence the price you pay for your premium as it is a defining factor in determining the level of risk your driving will bring to Irish roads.

For instance, drivers under 25 and older than 70 are seen as being the riskiest to insure by insurance companies due to inexperience or old age, so they will pay more for cover.

Your job status: This will provide an insight into how often you use your car, and the type of journeys you are making. You are required to indicate whether you are employed, self-employed, unemployed, a full-time student or a stay at home housewife/husband.

Your occupation: Lastly, you will be required to list your occupation, as certain professions are considered to be higher risk than others. Certain occupations will also fall outside of the insurer's acceptance criteria and as such, they will not quote.

Step 3 - Tell us about your driving experience

The third step involves you telling us about your driving history and experience.

Your licence

- Licence type and duration held for: This is based on the number of years that have passed since your licence has been issued.

- Your driver number: For Irish driving licences, this is a 9 digit number found in field 5 of a paper licence and field 4d of a plastic card licence.

- Penalty points: You must disclose whether or not you have any active penalty points. You can check how many penalty points you have by contacting the Road Safety Authority on 1890 41 61 41, or the National Driver Licence Service on 076 108 7880.

No claims discount

A no claims discount (NCD) is given to drivers with a claims-free record and is built up over time.

- You’ll be asked how many years of no claims discount you have, and what your no claims PIN is. This is included by your insurer in your renewal pack.

- If you don’t have this PIN, you’ll need to supply a copy of your NCD document issued by your insurer. This will normally be after you purchase the policy.

- Provide us with the name of your current insurer and the expiry date of your policy.

Your claims history

Outline your claims history for the past five years, including the total number of claims made by or against you, or any of the additional drivers mentioned on your insurance application.

For example, this may include claims for windscreen damage, claims for theft or fire, any claims that were refused by the policy insurer, and any open claims.

If you’re unsure about any information relating to your claims history, you should contact your insurer at the time.

Step 4 - Add additional drivers

You can add up to 3 additional drivers to your policy, provided you submit the required information about their driving history.

You’ll be asked to determine whether the additional driver is the main driver or a named driver. This indicates how often they will drive the vehicle. Their relationship to you - whether they are a parent, a child, a spouse etc - will also affect the price of your premium.

Based on this information your insurance policy will be adjusted in accordance with the risk factor your added driver brings to your cover.

Step 5 - Declarations

Before receiving your car insurance quote, you’ll be asked some final questions and be required to review relevant declarations, and terms and conditions.

Step 6 - Your results and purchase

Once you submit your details, your cover options will be displayed instantly. You can filter your results by adjusting the cover type, payment type and the amount of claim excess.

As well as standard cover, you’ll have the chance to purchase optional add-ons, such as legal expense protection or full no claims discount protection, all of which will be reflected in your premium breakdown.

Take a look at our guide on additional extras to learn more.

When you have decided on the policy that suits you best, press the 'proceed' button to be redirected to your new insurer's site. Here you will be able to complete the payment process for your new car insurance policy.

If for whatever reason you do not complete the purchasing process, your new insurer will ring you to iron out any problems or queries you may have.

As this is a paper-free service, any documents will be sent to you and can be signed digitally.

On hand to help

Our expert advisors will be on hand to help should you require any assistance during the application process.

Compare and cut costs with bonkers.ie

Reducing car insurance isn’t the only way we strive to keep money in your pocket.

You can also compare deals and prices for a range of other products on bonkers.ie, including energy, broadband, banking and other insurance products. So get started today and begin your savings journey with us!

Helpful guides for motorists

If you found this guide informative, take a look at the other guides in the eight-part series on how to take out car insurance on bonkers.ie.

- This guide outlines the different topics and information contained in the various guides in this series.

- Learn about the cooling-off period and what you should do when you want to cancel your car insurance policy.

- Read our two-part mini-series on the most common car insurance-related questions. Part 1 focuses on general queries, while Part 2 focuses on more niche ones.

- Get to grips with car insurance terminology here.

- Taking out car insurance can be overwhelming, so we have compiled a list of the most important aspects you should keep in mind during your search.

- Our guide on optional extras will help you tailor your car insurance cover to suit your needs.

Don’t forget that you can easily stay up to date on the latest car insurance news and top tips with our blogs and guides pages.

Have any questions?

If you have any questions about how to use our car insurance service, feel free to get in touch with us. You can comment below or contact us on Facebook, Instagram or Twitter.