Life insurance is one of the most common forms of insurance in Ireland. So what exactly is it and why do you need it?

Life insurance or life cover pays out a tax-free lump sum if you die during the term of the policy. It’s possible to have single life cover, where only one person is insured, or joint life or dual life cover, where two people are insured under the one policy such as you and your partner.

Life insurance can give you peace of mind that your loved ones will be kept financially secure if the worst should happen.

The tax-free money can help pay your family's bills, clear loans, cover your children's future education costs, as well pay for funeral expenses if you or your partner unexpectedly die.

Give me an example

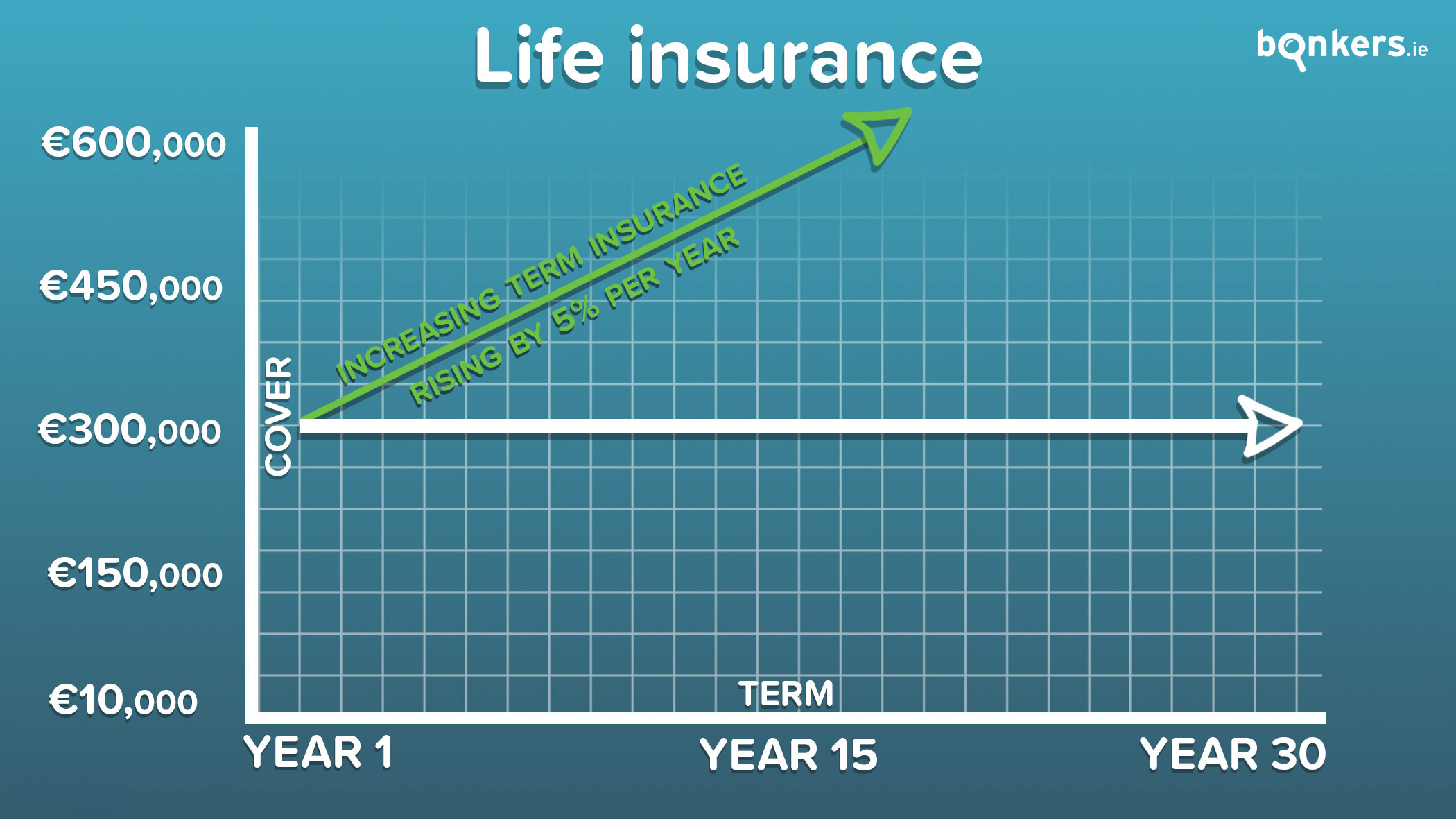

Let’s say you take out a life insurance policy for €300,000 over 30 years.

If you die at any time during the 30-year term of the policy, a tax-free lump sum of €300,000 would be paid out to your estate.

If, however, at the end of the term you’re still alive, nothing will be paid out and you’ll receive no refund of the premiums you’ve paid.

It’s also important to know that money will only be paid out in the event of your death. If you get seriously ill nothing will be paid (though there are other forms of insurance for this such as specified illness cover).

Do I need life insurance?

Not everyone needs life insurance and whether you need it will depend on your personal circumstances.

You will likely need cover if you have a family or others who rely on you for financial support or if you have no other life insurance benefits through your job or pension plan. If you have a young family, you will need more life cover than if your children are older, because the benefit will have to last longer.

On the other hand, you may not need any cover at all if you have no dependants or anyone who relies on your income. Similarly, if you already have life insurance cover through your pension plan or your employer there may not be a need for additional cover or you may only need a smaller amount of cover.

Before taking out life insurance it’s always a good idea to speak with a qualified financial advisor who will conduct a full financial review with you.

Additional benefits

Sometimes you can add benefits to your life insurance policy such as indexation or ‘inflation protection’. In this case, your level of cover (but also your premium) will rise by a fixed amount, usually 5% each year, to help keep up with inflation.

So using the same example as above, if you died in year one of your policy, €300,00 would be paid out. But if you died in year 10, almost €500,000 would be paid out by your insurance company as your cover has been increasing by 5% every year.

This type of cover is sometimes called increasing term insurance as the level of cover is increasing each year.

Specified illness cover, which pays out a tax-free lump sum if you're diagnosed with a serious illness covered by your policy, is a popular extra.

Another benefit that can be added is a conversion option. This allows you to extend the term of your cover at any point over the term of your policy without having to take another medical examination or answer any new questions about your health, regardless of your age or health status. Convertible premiums are usually more expensive than non-convertible premiums. You can learn more about convertible life insurance here.

Hospital cash is another popular benefit that people add. This pays out a cash sum for every day you spend in hospital, usually up to a maximum of 365 days.

Terminal illness benefit

Usually you have to die before a payment will be made.

However some policies will have what's called a terminal illness benefit.

In this instance, if you're diagnosed with a terminal illness and have fewer than 12 months to live, your life insurance company will pay out the full amount of life cover as of the date of diagnosis.

A terminal illness is an illness where, in the opinion of your consultant and your insurer's chief medical officer, you won't survive the next 12 months.

Many, but not all, life insurance policies come with this benefit as standard nowadays.

I already have mortgage protection, do I still need life insurance?

Generally, mortgage protection is designed to pay off your mortgage if you die, not to provide a cash sum to your dependants. So you’ll usually need separate life insurance to provide a cash lump sum if you have a family.

Another way of looking at it is that mortgage protection protects the bank and ensures the mortgage they’ve lent you will be repaid even if you die. Life insurance protects you and your family and ensures your dependants will be financially secure if you die.

You can learn more about why you should take out life insurance in this guide.

Who sells life insurance in Ireland?

There are lots of providers who sell life insurance in Ireland such as Aviva, Irish Life, New Ireland, Royal London, and Zurich to name a few.

Do I need to undergo a medical examination to take out life insurance?

It depends. If you’re in fairly good health then the answer is usually no.

However if you have a history of illness, are over a certain age, or are applying for a large amount of cover then you may need to undergo a medical examination or complete an over-the-phone medical questionnaire, which will be organised and paid for by the life insurance company.

Your life insurance company may also have a medical questionnaire sent to your doctor for him or her to complete.

How much is life insurance?

The cost of your policy will depend on several things such as the amount of cover you need, how long you want the policy to run for, your age, your health status, and whether you want single life cover or joint/dual life cover.

If you’re a smoker you’ll also pay far more for your cover than a non smoker would. Around double in fact.

A non-smoker in their mid 30s who takes out standard cover for €300,000 over 30 years could expect to pay around €30 to €35 a month.

How do I apply?

You can apply for life insurance through bonkers.ie. We deal with all of the main life insurance providers in Ireland such as Irish Life and Zurich, meaning we can find you the best quotes for the cover you need.

Simply fill in your requirements for life insurance in our online form and compare policies and prices. Once you’ve found the right policy for you, submit your application and then one of our Dublin-based advisors will be in touch. And we'll on hand throughout the entire application process until your policy is issued.

Don’t forget that you can also compare serious illness cover, mortgage protection insurance and home insurance on bonkers.ie too.

Take a look at our other insurance guides

If you’re looking for more insurance information, we have a range of helpful guides that you may benefit from. Consider taking a look at the following:

- Taking out insurance cover can be confusing at the best of times and it’s a good idea to ask as many questions as possible. Here we answer a list of 16 common life insurance questions.

- We mentioned that specified illness cover is a benefit that can be added to your life insurance policy. Here are seven things to know before taking out specified illness cover.

- If you’re looking at buying a home, mortgage protection cover is a necessity. It’s important to know what key factors to consider when buying mortgage protection insurance.

- Insurance provides peace of mind but many of us are overpaying each year. In this guide we outline how you can easily reduce your insurance costs.

You can stay up to date with all of the latest insurance news and top saving tips with our blogs and guides.

Have any questions?

Wrapping your head around insurance policies can be tricky.

If you need any help when applying for life insurance or have any questions, let us know! We have an in-house insurance broker team, made up of qualified advisors who are happy to help.

And you can get in touch with us on social media.