Mortgage protection is obligatory for most mortgage holders in Ireland. So what exactly is it and why do you need it?

What is mortgage protection insurance?

Mortgage protection, also called mortgage life insurance, is a form of life insurance that’s designed to pay off the outstanding balance on your mortgage in the event of your death.

The policy runs for the same length as your mortgage and ensures that if the worst happens, and you die before your mortgage has been fully repaid, a lump sum will be paid out to cover the balance that’s remaining.

If you’re buying a property by yourself you’ll take out a single policy.

If you’re buying with your partner you’ll need a joint or dual life policy where two people are insured under the one plan.

Under a joint policy, there will be a payout on the death of the first person only. The mortgage will be cleared and the policy will then end.

With a dual life policy, there can be two payouts. There will be a payout on the death of the first person. This will clear the mortgage. The policy will then continue and if your partner also died during the policy term, there would be a second payout which would go to your estate.

Give me an example

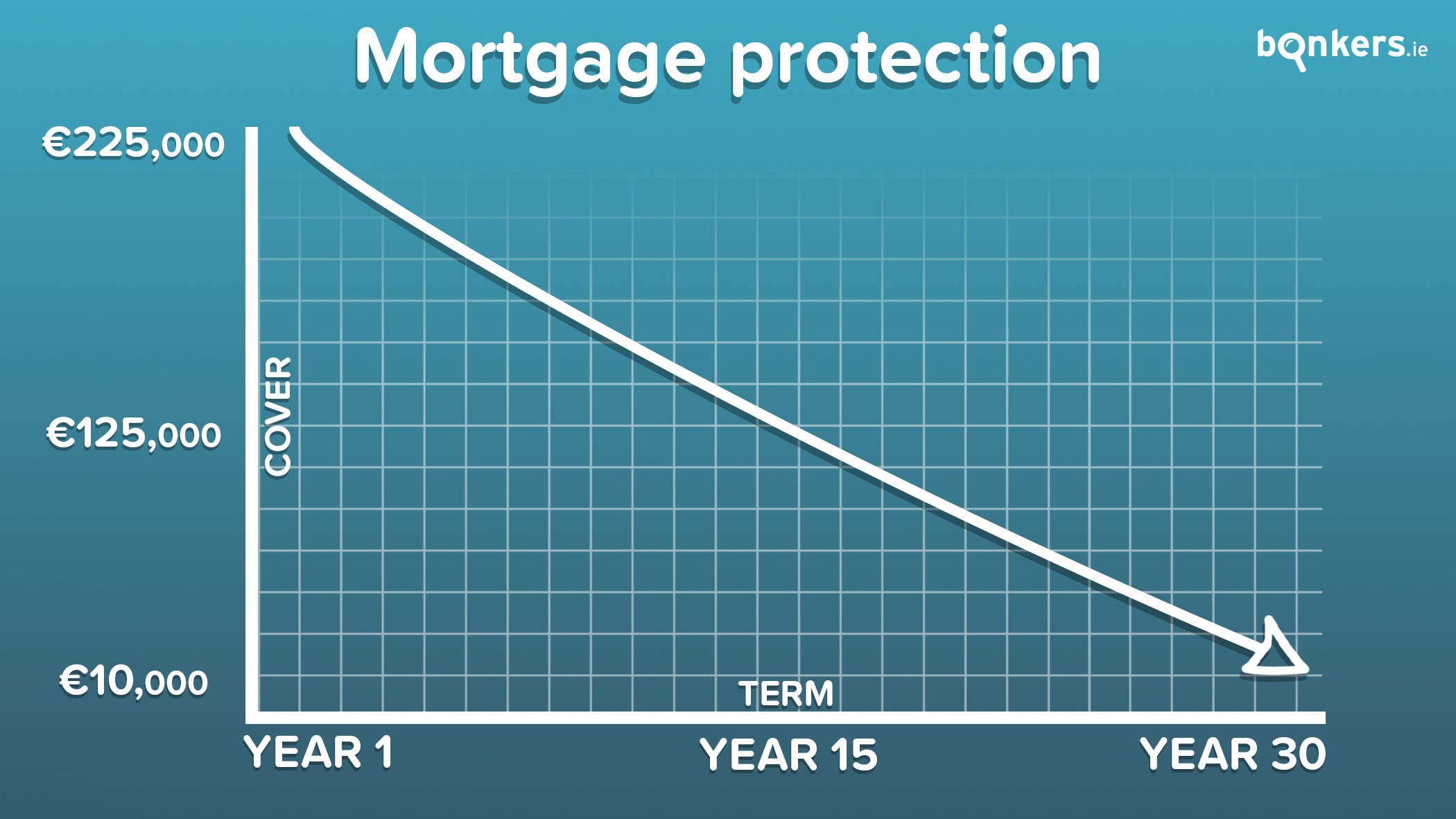

Let’s say you’re buying a house for €250,000. You have a 10% deposit and therefore take out a mortgage of €225,000, which you’re repaying over 30 years.

In this example, you'd need a policy with cover of €225,000 over 30 years.

With mortgage protection the amount you’re insured for decreases each year to broadly match what's left on your mortgage.

So if you were to die in year one, almost €225,000 would be paid out as that’s what would still be outstanding on your mortgage. If you were to die in year 15, around €125,000 would be paid out. However if you died towards the very end of your mortgage, maybe only a few thousand euro would be paid out as that’s all that would be left on your mortgage. It is for this reason that mortgage protection tends to be cheaper than other forms of life insurance.

It’s also important to know that money will only be paid out if you die. If you get seriously ill or can’t afford your mortgage repayments nothing will be paid out (though there are other forms of insurance such as specified illness cover and mortgage repayment protection for this).

How does mortgage protection differ from life insurance?

As described above, with a mortgage protection policy the level of cover reduces each year.

With life insurance the level of cover remains constant and can even increase each year to help keep up with inflation. It is for this reason that life insurance usually costs more than mortgage protection.

Who needs to take out mortgage protection?

In general everyone who takes out a mortgage in Ireland must get mortgage protection as your lender won’t allow you to officially draw down your mortgage until it’s in place.

Many prospective home buyers are often unaware of this requirement and scramble at the last minute to try get a policy in place so they can move into their new home.

So if you’re looking to buy your first home, our advice is to arrange cover as early as possible in your mortgage journey.

You can find out more about when the right time to apply for mortgage protection is here.

Are there any exceptions?

There are some instances where mortgage protection isn’t always required such as

- You’re over 50 or

- You’re buying an investment or buy-to-let property as opposed to your own home

- You cannot get mortgage protection due to health issues, or can only get it at a much higher premium than normal or

- You already have enough life insurance to pay off your mortgage if you die. This might be through other insurance that you have or through any death-in-service benefits provided by your employer

In these instances it's at the discretion of the lender as to whether they'll require cover.

Policy assignment

When you purchase mortgage protection insurance it’s important to know that the policy will be assigned to your bank or lender. In other words, they become the owner of your insurance plan and not you.

Once your policy has been finalised your insurer will send what's called a “Confirmation of Assignment” letter to your bank, which effectively means that the cheque for your mortgage can then be issued and you can get the keys to your new home.

In the event of your death, your bank or lender is paid first and any balance remaining is then paid to your beneficiary.

Who sells mortgage protection?

There are lots of providers that sell mortgage protection in Ireland such as Aviva, Irish Life, New Ireland, Royal London, and Zurich to name a few.

Many banks also sell mortgage protection. They don’t underwrite the policy themselves but act as a retail channel or intermediary for a life insurance provider and tend to be quite expensive.

By law, you’re under no obligation to take out mortgage protection from the same lender that’s giving you your mortgage and you’re free to shop around for the best value.

Do I need to undergo a medical examination to take out mortgage protection?

It depends. If you’re in fairly good health then the answer is usually no.

However if you have a history of illness, are over a certain age, or are applying for a large amount of cover then you may need to undergo a medical examination or complete an over-the-phone medical questionnaire, which will be organised and paid for by the life insurance company.

Your life insurance company may also have a medical questionnaire sent to your doctor for him or her to complete.

How much is mortgage protection?

The cost of your policy will depend on several things such as:

- The size of your mortgage and therefore the amount of cover you need

- How long you need the policy to run for - it must match the term of your mortgage

- Your age

- Your health status

- Whether you want single life cover or joint/dual life cover

Smokers will also pay more for cover than non-smokers, so another good reason to try kick the habit!

How do I apply?

You can apply for mortgage protection through bonkers.ie.

We deal with all five of the main mortgage protection providers in Ireland meaning we can find you the best quotes for the cover you need.

Head to our easy-to-use comparison service, input a few details, and start comparing premiums. Once you’ve found the right policy for you, our team of financial experts will help you get your policy in place.

In some cases, you can get you covered in less than one hour!

And don’t forget that you can get life insurance, serious illness cover and home insurance through bonkers.ie too.

Check out our other insurance guides

Here on bonkers.ie we have a wide variety of insurance guides that will help you make informed decisions.

If you’re looking for further information about insurance, take a look at the following:

- We outline six key things to consider when taking out mortgage protection insurance in this guide.

- Being refused mortgage protection insurance can jeopardise your chances of getting a mortgage. We take a look at what you can do if you’re declined mortgage protection insurance in this guide.

- If you’re considering taking out life insurance, it’s a good idea to ask as many questions as possible. Here’s a list of 15 common life insurance questions answered.

- Insurance provides us with peace of mind and puts us at ease, however many of us end up overpaying each year. In this guide we outline how you can easily reduce your insurance costs.

You can stay up to date with all of the latest insurance news and top saving tips with our blogs and guides.