One of the main obstacles to getting on the property ladder in Ireland is obtaining mortgage approval from your chosen bank or lender.

However, oftentimes applicants find themselves stuck when they discover that their application has actually been rejected.

While discouraging, a mortgage refusal doesn’t mean you won’t be able to get approval in the near future. To get mortgage ready, you need to fully understand the reasons you were denied a loan, so that you can overcome the issue.

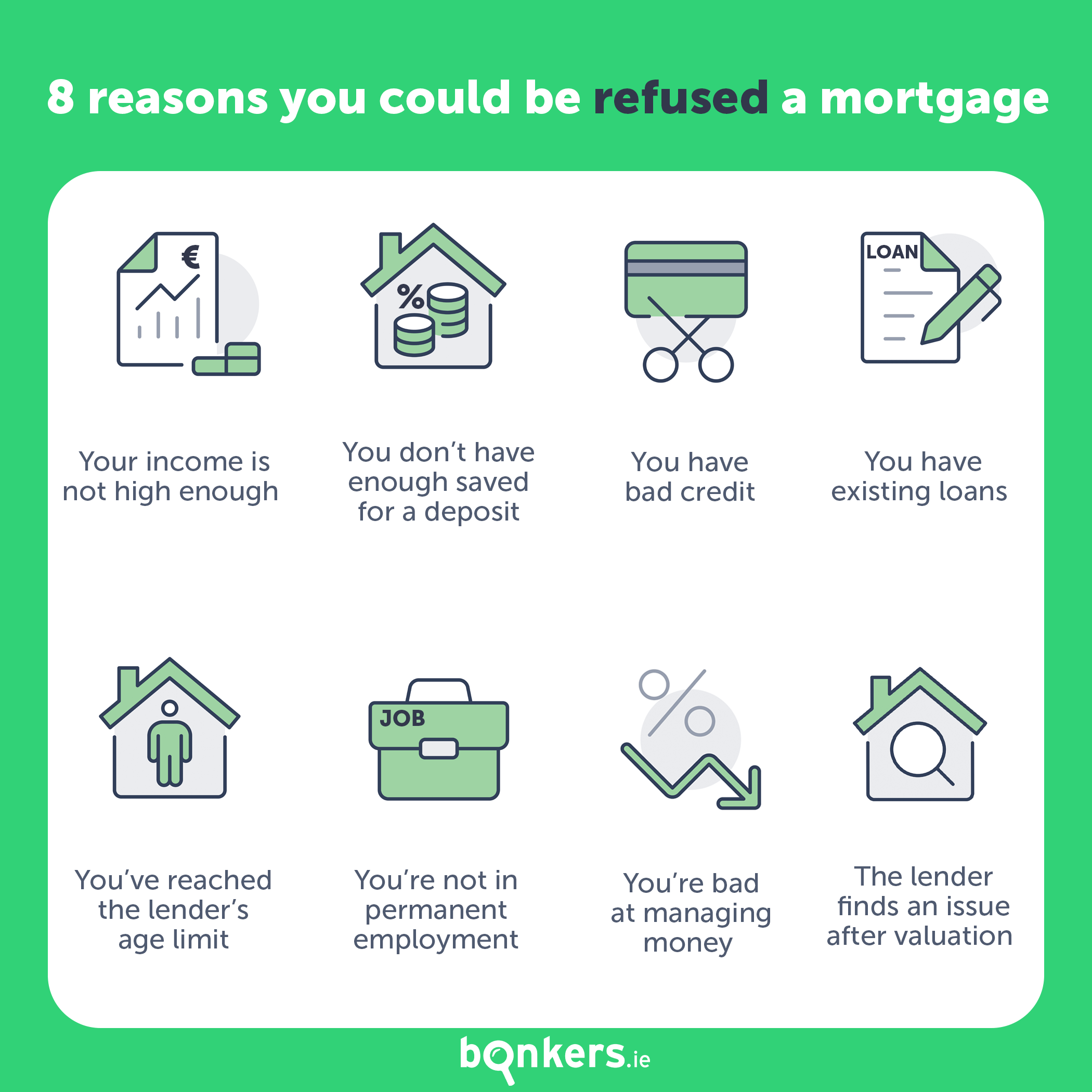

That’s why we decided to explore the eight main reasons why you could be refused a mortgage.

1. Your income is not high enough

It’s possible that your application was denied because your current income is not sufficient enough to repay the amount you wish to borrow.

Under the Central Bank’s mortgage lending rules, mortgage applicants are only permitted to borrow 4 times their gross annual income. This goes for both single and joint applicants.

For example, if you have a salary of €45,000, then the maximum mortgage you could be approved for is €157,500.

However, you may be eligible for a loan-to-income exemption. In any calendar year, lenders can offer an exemption to 20% of the mortgages they provide. Even still, lenders give out exceptions sparingly.

Take a look at our guide on the Central Bank’s mortgage lending rules to learn more.

2. You don’t have a full deposit

The second reason you could find yourself receiving a mortgage rejection is because you don’t have the minimum deposit required under the Central Bank of Ireland’s loan-to-value limits.

In Ireland, first-time buyers are required to have a deposit of 10%, while second-time and subsequent buyers require a 20% deposit.

However, you may be eligible for a loan-to-value exemption. This is when a lender reduces the deposit amount, so that instead you may be able to purchase the property with a smaller deposit.

Lenders can offer loan-to-value exemptions to 5% of first-time buyer applicants who may have a deposit of less than 10%.

They can also offer loan-to-value exemptions to 20% of second-time buyers who have a mortgage deposit of less than 20%.

3. You have a bad credit history

If you have a history of bad credit, you may struggle to obtain mortgage approval. This can happen if you didn’t pay off previous loans, or missed repayments in the past.

When you apply for a mortgage, a lender will run a check to view your credit history on the Central Credit Register (CCR). This report will show the lender your past and current credit commitments, and your capacity to manage and repay loans.

Your outstanding credit will help lenders assess your affordability, and can directly affect the amount you could borrow.

We’d recommend that you review your credit history before submitting a mortgage application.

If you need to improve your credit history consider:

- Paying off any arrears you may have

- Reduce the balance of your loan, credit card, or overdraft

- Try to avoid missing any repayments

- Don’t apply for new credit products

4. You have outstanding loans

Most people will need to take out a loan at one time or another throughout their life, whether it’s for a car, education, or a holiday. However, it’s a good idea to hold off on taking out a loan if you’re planning on applying for a mortgage in the near future.

This is because having other existing loans may hinder your ability to get a mortgage.

If you do have a hefty loan to repay, you could be refused mortgage approval. On the other hand, sometimes the amount you can borrow may just be reduced.

5. You’ve reached the lender’s age limit

Usually, lenders require borrowers to have paid their mortgage off by the time they’ve reached 65 or 70. This can cause difficulties for those looking to take out mortgages for longer durations, which can be up to 35 years with some lenders.

That means if you’re over the age of 40 and are applying for a mortgage, you’ll experience difficulty applying for a mortgage with a term of 30 years.

If this is the case, you can try to apply for a mortgage with a shorter term, if this is financially viable. Alternatively, you could apply for a smaller mortgage, over a shorter term.

6. You’re not in permanent, full-time employment

The way we work has changed drastically over the years and nowadays people tend to stay with the same employer for shorter periods of time and move around jobs more frequently.

While understanding of this, lenders need to be able to trust that you’re in a financially stable position so that you can meet mortgage repayments.

Lenders look more favourably at potential borrowers who are in permanent employment over contracted or temporary roles.

Typically lenders will require that mortgage applicants be in their current role for at least 6 months, and have passed their probationary period.

If you only recently started a job or your job is at risk, you could discover that your mortgage application has been rejected.

7. You’re bad at saving and managing money

If your bank statements show that you cannot save properly or that you have poor money management skills, you may struggle to obtain mortgage approval.

Similarly, if you have excessive gambling habits, your application will be frowned upon and you likely won’t receive approval. Gambling debts can accumulate fast and contribute to bad credit history. Lenders are wary when they see applicants sending money across to their betting account regularly.

If you want to better manage your money and savings, consider:

- Closing any gambling or online betting accounts

- Making a budget and setting aside a certain amount for savings each month

- Labelling all outgoings clearly, e.g. rent, savings, etc. so the lender can see where your money goes

- Cancelling any subscriptions you don’t use anymore

- Avoiding erratic spending

8. The lender finds an issue after the valuation

When purchasing a property, a lender will have its own independent valuation carried out on the property before agreeing to give you the mortgage.

This is to ensure that the property fits within its lending criteria and to check that the amount you’ll be paying represents the market value correctly.

If the lender thinks that the property isn’t worth what you’ve agreed to pay for it, they may decide to alter the amount they’re willing to let you borrow, or sometimes they will pull out completely. This is known as a down valuation.

If this happens, you could try to:

- Increase your deposit

- Renegotiate the price with the seller to meet in the middle

- Appeal against the valuation survey

- Apply for a mortgage with another lender

The lender may also refuse your application if other issues come to light when the property is valued, such as:

- Asbestos

- Damp

- Japanese knotweed

- Structural problems

- Roof problems

- Subsidence

Similarly, if the property is not of standard build, you may struggle to obtain mortgage approval.

What to do if you’ve been refused a mortgage

If you’re experiencing trouble with the mortgage application process we’d recommend that you speak to a mortgage advisor or broker, who will be able to help you get mortgage ready.

Local Authority Home Loan

If you have had two mortgage applications refused by lenders but you meet other certain criteria, you may qualify for a Local Authority Home Loan.

In January 2022, the Government announced this new mortgage scheme available to first-time buyers and Fresh Start applicants.

The scheme is designed for those looking to purchase new or second-hand residential properties and for self-builds. To qualify, you must provide proof of insufficient mortgage offers of finance from two regulated financial providers.

There are two fixed-rate loans available and the scheme has limits on the maximum market values of the property that can be purchased or built.

The loans are available through all local authorities nationwide.

More helpful mortgage guides

- Find out what documents you need for a mortgage here.

- Learn about the various different interest rates available.

- Get familiar with these 25 common mortgage terms which will help you on your mortgage journey.

- If you’ve just returned from living abroad and are looking to get a mortgage in Ireland, check out our guide on the topic.

You can stay up to date with the latest mortgage news and advice with our blogs and guides.

The bonkers.ie mortgage broker service

If you’re thinking about applying for a mortgage and feel you’re ready to submit an application, our free mortgage broker service will help you on your journey.

Our service is fully digital and paper-free, meaning you can upload documents from the comfort of your home. One of our experienced mortgage experts will be on hand to guide you through the entire mortgage application process.

Don’t forget that you’ll also need mortgage protection insurance and home insurance to draw down your mortgage, both of which you can get here on bonkers.ie.

Let’s hear from you

Can you think of any other reasons you could be denied a mortgage? We’d love to hear from you.

You can get in touch with us on Facebook, Twitter or Instagram.